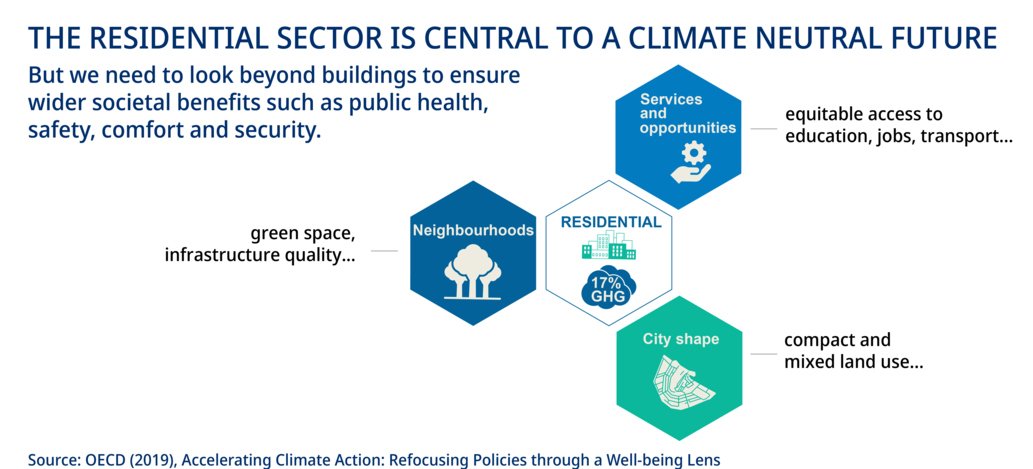

Governments spend some USD 340 billion a year supporting the production and use of fossil fuels through direct subsidies and tax rebates. This is a substantial amount – comparable in size with the GDP of some countries. It is public money that could be spent on other priorities, including promoting and developing clean energy infrastructure. In fact, the amount invested globally in renewable energy was lower, at some USD 310 billion in 2017.

Shifting investment into low-carbon options could increase global GDP by roughly 5% by 2050, if we take into account the creation of new opportunities and the avoidance of the human and capital costs of climate change, from air pollution, coastal flooding, storm damage, drought and more.

Mobilising public and private resources across the financial spectrum is essential to generate the trillions of dollars needed for sustainable infrastructure, and to support capacity-building in developing countries and poorer communities. Public finance institutions, banks, institutional investors, corporations and capital markets all have a crucial role to play.

The good news is that the money is there. But we need to ensure that it is channelled to the right places. The estimated USD 2.5 trillion needed each year for developing countries to meet the challenge of financing infrastructure for the Sustainable Development Goals (SDGs) represents less than 1% of available global financial assets. Financing and maintaining dirty, fossil-fuel based plants and infrastructure would also cost many trillions of dollars. Together we must use policy levers such as pricing to redirect this finance away from unsustainable sources to ones that can help meet climate goals.

Governments must ensure that finance is aligned with achieving the rapid and radical transformations required, that it boosts innovation, and that inequalities are not aggravated.